Use cases of Blockchain- Beyond Crypto Currency

Although Bitcoin, the pioneer cryptocurrency, and its multiple variants are the most talked about use cases of the blockchain technology, the conceptual framework of blockchain can be used in many areas without even adhering to the architectural framework of cryptocurrencies. In this 3rd part of the series on blockchain, I want to explore possible application of blockchain in various areas.

P2P lending-: P2P lending is a way of fund flow from a lender to a borrower without an intermediary like bank. Traditionally, financial intermediation by institutions like bank involves a number of subordinate processes like credit scoring, collateral verification, guarantor verification etc. As supplier of funds, depositors or lenders to the banks through instruments like debentures / CDs etc. are kept by the intermediaries at arms-length distance from the borrowers. So the fund providers to the intermediaries are at the mercy of the latter’s capability and honesty for safety of their funds.

P2P lending is a way of lending and borrowing where lender(s) and borrower(s) are connected directly through a platform. The platform is a web based application that allows both potential borrowers and lenders to get registered on the platform. Although many P2P platforms have sprung up worldwide, it has yet to pose any challenge to the mainstream intermediaries

The blockchain based P2P lending may address the potential trust deficit between lenders and borrowers meeting on current P2P platforms. One of the earliest such a platform is Lendoit (https://lendoit.com/faq/). The process followed by this P2P platform is briefly described below

A registered borrower is first subjected to a credit scoring/verification process by third party companies before the loan application is published. How the cost of verification is defrayed is not available on Lendoit’s website. A smart loan contract (SLC) containing loan details get created. Lenders can make an offer for each SLC. Once a borrower agrees to the terms and conditions of offer the SLC get executed and funds are transferred to the borrower. All subsequent processes of loan disbursements, payment reminders, crediting of repayments to lenders’ accounts etc. are managed by the SLC. A Smart Reputation contract (SRC), providing credit profile of the borrower, accessible to everyone gets created. A lender is protected through a Smart Compensation Fund where a percentage of every loan is stored in order to compensate for the defaulted ones. All smart contracts are created on Ethereum platform

Foreign Exchange Remittance:- It is well known that fiat money transfer across national boundaries has two channels – a legal one through banking system and another illegal one-through a network of agents. In both cases, money does not get transmitted physically but only through a messaging system between the participants in the process.

The legal system is dominated by SWIFT, a Belgian Cooperative society. Founded in 1973. “FT” in SWIFT stands for Financial Telecommunication, a clear indication to the effect that an efficient and trustworthy message flow management is the main function of the organization. SWIFT does not maintain any account of its clients and provides no guarantee of successful completion of any cross-border payments. Over the time SWIFT has extended its network to non-bank financial institutions also. Apart from money, exchange of securities is also being carried out on SWIFT platform.

The illegal system, popularly known as hawala, also works largely as a messaging system between parties involved. When A wants to transfer, say Dirham, from UAE to an Indian recipient B, A would deposit the money with an agent X at UAE, who would message the receipt amount and identity of the beneficiary to X’s counterpart Y in India. Then B would collect the money in INR in India from Y, after an agreed identification process.

Both the systems work as messaging system. Wire transfer through SWIFT may take several days as the message passes through a number of banks/ other intermediaries in two or more countries. Rising to the challenge of making wire transfer faster and more secure SWIFT launched SWIFT global payment innovation (SWIFT gpi) in 2017. Today 90% of wire transactions are credited within 24 hours, including 40% credited within 30 minutes in SWIFT network.. Interestingly, SWIFT is also exploring the possibility of using blockchain to address security issues and for prevention of any financial crime through hacking.

Ripple Lab is a software company which introduced XRP as a cryptocurrency to facilitate money transfer, particularly cross border one. According to Investopedia, Ripple functions as a digital hawala service. The only difference is that the pair (X,Y) forms a trusted network amongst themselves and A must repose trust on the pair to deliver INR to B.

In the crypto world this trust is achieved by using cryptography and through a verification methodology known as consensus algorithm. A payment platform like Ripple has taken certain elements of cryptocurrency based payment system but not all. First of all, all XRP coins, 100 billion in number, were generated at its inception. Unlike Bitcoin and similar other cryptos, no new XRP gets generated through a mining process. But like Bitcoin, there is no central authority to ensure validity of currency transactions.

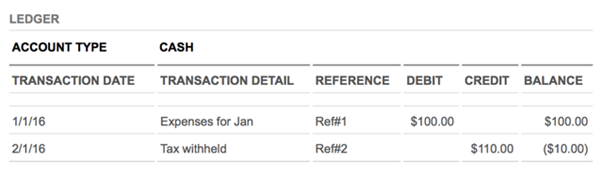

Instead of miners, Ripple has validators to validate transactions on Ripple network and record them in a block, called “ledger version” by Ripple. The network also has a list of “trusted” validators called “Unique Node List”. These nodes are specifically configured to “participate actively in consensus, run by different parties who are expected to behave honestly most of the time.” This pre-determined validators obviously makes consensus algorithm somewhat akin to correspondent banks who creates the bridge between sender’s bank and receiver’s bank. Having the transaction in a blockchain does not add much value to both sender and receiver.

Bitwage is another interesting example of use of blockchain in cross-border money transfer business. The “wage” in the company’s name is a reference to the company’s main business of providing payroll services to employees or freelancers and the “Bit” part refers to the company’s use of Bitcoin as another payment medium apart from payment by local currencies. The company’s website gives the following example of using a Philippine crypto exchange (coins.ph) for money transfer in local currencies.

- Set up an account at coins.ph. This is a Bitcoin exchange, but you can automatically convert Bitcoin received from Bitwage into Philippine Pesos. There’s no need to know how to use Bitcoin at all. Make sure you do identity verification with coins.ph to have your account fully functional.

- Grab your peso wallet Bitcoin address from Coins. When Bitcoin is sent to this address, it will arrive in the form of pesos to your Peso Wallet.

- Add your Peso Wallet Bitcoin address to Bitwage as a Digital Currency Allocation and you’re all set.

This apparent simplicity of the money transfer mechanism hides a significant amount of risk that a sender as well as the corresponding receiver would be exposed to. Apart from exchange rate risk, the settlement risk is extremely high in this scenario. The following lines in user agreement with Betur Inc. the owner of Coins.ph is quite revealing:

Your account with us is not a bank account. Our services are not financial instruments. No interest will be paid on any funds or currency you use to purchase or trade for any other currency, and such currency is not insured by the company or any government agency. (see here)

Supply Chain Management (SCM):

Supply chain management is a higher form of Enterprise Resource planning where the enterprise ecosystem includes a chain of independent companies, bound together in a hierarchy and participating in a coordinated manner to deliver final goods. SCM differs from mere outsourcing of some components of a final product in respect of degree of coordination that it enforces on all participants in the chain.

For example, Apple, being the owner of the brand “Apple” and its core technology, has to bear the ultimate responsibility for expected performance of its products. So while cost minimization objective can lead to outsourcing of some key components of the final product, tight monitoring of the decentralized production process is an essential pre-requisite to remain competitive and retain brand-equity. Apple has 785 suppliers located in 31 countries (see Clarke & Boesmar 2015). And to get the final products to points of sale, Apple “embeds” its” values into every detail”: “From the suppliers we choose to work with, to the materials in our products, to the processes and equipment we use to make them,”( see Apple_SR_2022_Progress_Report )

In today’s world, supply chain management of a global enterprise must take into account, apart from managing product life cycle, “safeguarding the rights, health, and safety of our employees, customers, and the people in our supply chain.” Meeting these objectives over and above the ones which are intrinsic to SCM, require information sharing by all the stakeholders in a given SCM network. It is in the interest of every participant to ensure that shared information is trustworthy and free from any manipulation and tampering. Blockchain technology is a potential solution to address these requirements. Some of these requirements are detailed below.

Sustainability: Every SCM functions in a given social milieu, societal sensitiveness to environmental issues and legal framework for working conditions at different countries. Any failure at any part of the chain can not only be disruptive of the entire production process but can have serious legal and reputational consequences for the enterprise responsible for managing the supply chain. For example, on April 24, 2013, a building in Dhaka, the capital of Bangladesh, collapsed resulting in death of more than one thousand garment factory workers. Five factories located in this building produced garments for JC Penney; Cato Fashions; Benetton; Primark, the low-cost British store chain. The lessons learned from such accidents is that “buying firms must manage the uncertainty regarding the conditions in their supply chains as a crucial prerequisite for effective sustainable supply chain management (SSCM) and their own economic performance” (

Managing Information Processing Needs in Global Supply Chains). Information uncertainty also may cause bullwhip effect in a SCM where uncertainties at the lowest level of chain gets magnified as the information travels up the chain. For example, when a retailer misjudges a temporary and random surge in sale as an indication of rising demand and places order to the next distributor accordingly, and the distributor also in turn makes a wrong forecast, the error gets compounded and magnified at the manufacturer level. The final outcome could be sub-optimal decision making at various level like capacity expansion, planning for higher production, unexpected rise in inventory level etc.

Traceability: FAO has defined traceability as the “ability to trace the history, application or location of an item or activity by means of recorded identification” (FAO-Traceability https://www.fao.org/3/i6134e/i6134e.pdf)https://www.fao.org/3/i6134e/i6134e.pdf) .The importance of traceability can be understood from a recent event of deaths of nearly 70 children in the West African nation of Gambia, due to suspected use of cough and cold syrups produced by an Indian company. The Indian pharmaceutical industry, one of the largest in the world by volume, face a huge reputational risk. [Gambia cough syrup scandal: Police investigate deaths linked to Indian medicine. ; https://www.bbc.com/news/world-africa-63191406 9th October 2022

Provenance: The dictionary meaning of provenance is “origin” or “history of ownership” of a given object. In the context of SCM, provenance is important as customers of a product would be paying a premium when producer(s) of the product claims a certain origin of the product’s main ingredient. For example, the Evian is a premium brand of mineral water. It is sourced from a place near Evian-les-Bains, on the south shore of Lake Geneva. The provenance of the source of its water is a necessity for this brand to remain saleable.

Use of blockchain to address many of the above issues is still work in progress. Some of the most promising ones are briefly discussed below.

TradeLens is a supply chain solution developed by IBM and GTD Solution, a division of Maersk for global shipping industry, comprising shippers, freight forwarders, ports and terminals, ocean carriers, intermodal operators, government authorities, customs brokers etc. The system uses IBM’s Hyperledger Fabric blockchain technology and IBM Cloud. It is a permissioned blockchain. According to IBM, five of the top six global shipping carriers are now integrated onto the platform contributing to the digitization of documentation and automated workflows.

Trustchain is a blockchain based supply change management solution for Jewellery business. IBM, together with a consortium of leading diamond and jewellery companies from around the world are collaborating to build this application. Aa Forbes article has reported multiple blockchain initiatives by the diamond industry. The Gemological Institute of America now offers blockchain-enabled diamond grading reports, De Beers has unveiled a blockchain called Tracr, Everledger has partnered with Gübelin Gem Lab to create the Provenance Proof Blockchain. But diamond being a physical non-fungible article, the possibility of using blockchain is highly limited

Healthcare is one industry which has an urgent need for a blockchain like technology. The healthcare related data of an individual patient may be kept with different healthcare providers, depending on the nature of services required by the patient. Seamless exchange of information between the service providers without compromising the privacy of the patient is of utmost importance to every stakeholder in the system. In most of the countries there is no central authority which collects, manages and disseminates all healthcare related data of individuals in a manner that ensures data integrity, data privacy and access legitimacy. General Data Protection Regulation or GDPR compliance is also an important requirement in European Union

The US Food and Drug Administration (FDA) has enacted The Drug Supply Chain Security Act (DSCSA) to enhance drug supply chain security by 2023. Under this act it should be possible to trace the supply chain for any packaged drug from the level of manufacturers, repackagers, wholesale distributors and dispensers (primarily pharmacies). MediLedger Network is a blockchain based supply chain management application in medical industry “for data alignment, validation and transaction settlement between trading partners”. In June 2019, the MediLedger Project, a working group of 24 industry leading pharmaceutical manufacturers, distributors, retail chains, logistics partners and solution providers, was accepted by the FDA as one of their approved proposals. The working group’s purpose was to evaluate blockchain technology, like the MediLedger Network, in the track and trace of prescription medicines in the United State(see here).

Medicalchain is a blockchain enabled Electronic Medical Record management system The application is linked into existing electronic medical record software and act as an overarching, single view of a patient’s record.( here}.

IBM’s has created a blockchain based food traceability solution called FoodTrust. Walmart has implemented a food tracking program to collect environmental data from end-to-end, across the food supply chain using IBM’s FoodTrust. JD, a Chines e-commerce giant, Walmart, IBM, and Tsinghua University National Engineering Laboratory for E-Commerce Technologies launched the Blockchain Food Safety Alliance, which is designed to enhance food tracking, traceability and safety in China to achieve greater transparency across the food supply chain.

Refernces:

Clarke Thomas • Martijn Boersma (2015). The Governance of Global Value Chains: Unresolved Human Rights, Environmental and Ethical Dilemmas in the Apple Supply Chain. Journal of Business Ethics

Published online 30:July2015

Dhia Zubaydi Haider Dhia et al (2019) Review on the Role of Blockchain Technology

in the Healthcare Domain. Electronics, 8, 679 available online at www.mdpi.com/journal/electronics

Yang Guang , Chunlei Li Kjell E. Marstein (2019) . A blockchain-based architecture for securing electronic health record systems Concurrency and Computation: Practice and Experience