RBI has issued a concept note on CBDC on October 7, 2022. The stated objective for publication of this note is “to create awareness about CBDCs in general and the planned features of the digital Rupee”. Incidentally in February 2020 RBI bulletin had published an article on Distributed Ledger Technique. This article had discussed DLT initiatives of 7 central banks. Interestingly, the concept note does not even refer to this article.

In 2020, another article documented in detail (Opare and Kim 2020), a large number of ongoing CBDC initiatives of many central banks and classified these experiments into 3 groups based on their year of initiation. The authors have listed 10 Central banks in the Early Adopter group, each of which began their CBDC experimentation between 2015-2016. It was, therefore, expected that RBI would evaluate the lessons learnt from these projects and come out with a more detailed feasible plan for its envisaged CBDC journey.

It may not be out of place to note here that in April 2022, Indonesia’s central bank and the Bank for International Settlements (BIS) Innovation Hub announced launching of a global hackathon on 3 potential areas of CBDC’s uses. These areas are: use of CBDCs as a medium of exchange; use of CBDCs in a central bank’s financial inclusion initiatives; and use of CBDCs in cross-border payment system.

Coming to the main content of RBI note, I would like to dwell on certain aspects of CBDC implementation that would be relevant in the context of India, a country of 1.38 billion people and which have been either not dealt with or dealt with perfunctorily in the concept note.

1. Financial Inclusion as one of the objective of CBDC (section 3.3.5 page 20 of the Note): CBDC is neither necessary nor sufficient for financial inclusion. Predominance of cash as medium of transaction is one indicator of a financial exclusion. The share of ”money in circulation “in M1 is 59% in India (end March 2022) while for USA it was only around 11% (end august 2022). For China, this figure was around 13% at the end of 2017. So financial inclusion is more of a function of formalization/ corporatization of economy and not of the form of money in circulation.

2. [F]irst and fundamental question that needs to be answered is the choice of technology platform (section 5.1 page 31).: Here lies the major confusion that RBI internal committee is plagued with. Once CBDC is designed as a platform based medium of payment like a bank account, it loses the main characteristics of paper money-that is instant settlement of a monetary transaction. One does not need an internet connection or a mobile connection for verification with a third party in case of a paper money mediated transaction. You should be able to make a cash payment and, therefore, payment with CBDC at the top of Everest or in a submarine at the bottom of Indian ocean.

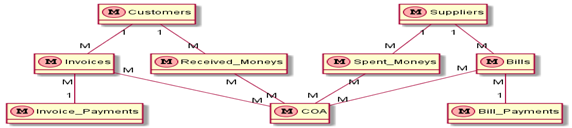

3. DLT could be considered for the indirect or hybrid CBDC architecture (5.2.2.2 page 32): The word “could” is somewhat equivocal. In an “Indirect Model”, “consumers would hold their CBDC in an account/ wallet with a bank, or service provider. …. The central bank would track only the wholesale CBDC balances of the intermediaries. ”(Section 4.3.2 page 24). It follows that the responsibility of maintaining DLT would lie with the intermediaries. It is not clear whether DLT would be blockchain based or not. If blockchain is not to be part of any solution, then the architecture of any DLT needs more clarification which is missing from the concept note. It is not clear who will bear the cost of maintaining DLT, if it is to be based on blockchain. Will it be a permissioned or permission-less? If an intermediary issues a CBDC to its customers, can that customer use that CBDC in another place which is under the jurisdiction of another intermediary? The concept note is silent on all these issues

4. Further, systemic checks through third party validation should ensure that in case of a token system, only such tokens issued by the Central bank are circulating in the ecosystem. Additionally, a competent party should be able to verify identity information before a participant is allowed to join the CBDC network. (section 5.4, page 33). This requirement of RBI’s CBDC can be considered as the last nail on the coffin of RBI CBDC. RBI annual report of 2022 puts the total number of banknotes in circulation at 1305326 lac or 130.5 billion pieces. If each note participates at least one transaction in a year, at least 1 billion transactions need to be validated in one-year period. I left to the imagination of my readers about the feasibility and cost of such an exercise. Even verification of half a billion transactions will be a humongous task. Furthermore, verification of identity information of a participant in CBDC network can be considered as a gross violation of privacy of a citizen. The very purpose of issuance of bank notes will stand completely negated by this requirement.

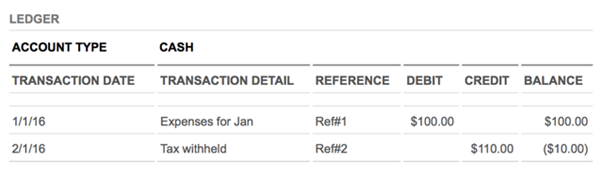

5. In offline mode, the risk of “double-spending” will exist because it will be technically possible to use a CBDC unit more than once without updating the common ledger of CBDC (5.6, page 34). I may humbly submit that I have proposed a detailed protocol by which the goal of preventing double –spending can be achieved (Nag 2021). My protocol tries to mimic all properties of paper note. The anonymity of transacting parties is largely achieved, although absolute anonymity cannot be achieved in a digital world.

6. Indirect Model: The concept note has argued that this model is the most suitable for India. Under this model, “RBI will create and issue tokens to authorised entities called Token Service Providers (TSPs) who in turn will distribute these to end-users who take part in retail transactions.” It is like a customer of a bank withdrawing cash from ATM/bank counter and then spending it outside. In this case CBDC will be withdrawn. But suppose the bank customer wants to pay CBDC to her maid who does not have a bank account, will it be possible? If that bank customer withdraws the money from her account at Mumbai and wants to spend it in Kolkata, how the ledgers will get updated? If the CBDC paying wallet has been issued by a Bank A and the receiving wallet has been issued by bank B, how the shake hand will take place in the absence of internet connection?

7. China has started experimenting with CBDC since 2016 and has now started issuing e-CNY, which has now 260 million individual users.

References

Fintech Department (October 2022). Concept note on Central Bank Digital Currency

Ashok K Nag (December 2021). A Proposed Architecture for a Central Bank Digital Currency for India. ORF Occasional Paper No. 340, Observer Research Foundation.

Bhowmick Sayantika and S. Majumdar (February 2020). Distributed: Ledger Technology, Blockchain and Central Banks RBI Bulletin

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/0BUL11022020FL847E8EFB34744BAEBB2E45E91759ACCD.PDF

Opare Edwin Ayisi and Kwangjo Kim (June 2020) A Compendium of Practices for Central Bank Digital Currencies for Multinational Financial Infrastructures in IEEE Access

https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9115606