How much forex reserve should RBI have? How much capital should RBI have? One simple answer to both these questions is- “it depends’. The obvious follow-up question is – it depends on what? And there is the rub. Is it given for a central bank to “die, to sleep – to sleep, perchance to dream” of a tranquil crisis free state of economy when reserves are a luxury, a framework for economic capital for all contingent situations can be worked out. Politicians always seek simple solutions to complex problems. In today’s world, most of the national economies are highly interconnected and are subject to “butterfly effect”. When flap of wing of a butterfly in Mexico engenders a hurricane in China, we call it a “butterfly effect”. The mathematical discipline, called Chaos Theory that deals with such complex interconnected non-linear systems, is based on the assumption that such systems are inherently unpredictable. There is thus neither any theoretical nor any empirical basis to expect that a central bank like RBI can predict with a certain measure of uncertainty the capital required to tide over any severe shock in next one or two year.

It is even debatable whether the concept of economic capital is applicable to a central bank. The economic capital of a firm is the amount of capital that would be required by the firm to remain solvent. The capital adequacy norm for a bank is a regulatory requirement towards that effect. The central banks, however, are not banks in ordinary sense. Although a central bank does function like a bank for government and banks, it is also an integral part of sovereign so far as it has unlimited power to issue risk free liabilities in its own currency. This prerogative of a central bank enables it to become the lender of last resort. Since, theoretically, a central bank can work with even negative capital, it is difficult to work out a threshold level of minimum capital that a central bank would require to remain solvent. Some recent evidences prove this point.

In January 2015, the Swiss National Bank abandoned its pegged currency regime and allowed Swiss franc to float. Resulting appreciation in EUR/CHF rate led to a massive loss in SNB’s foreign currency portfolio. The bank’s estimated loss of CHF41 billion in the following 3 months period till March 2015 came to be about 6.5% of Swiss GDP.

Another example of a technically insolvent central bank is the Czech National Bank (CNB). CNB was operating, at the end of 2007, with an accumulated loss of CZK200 billion, which formed 57% of the central bank currency in circulation and 6.7% of the country’s nominal GDP. The bank’s own negative capital stood at CZK 176 billion.

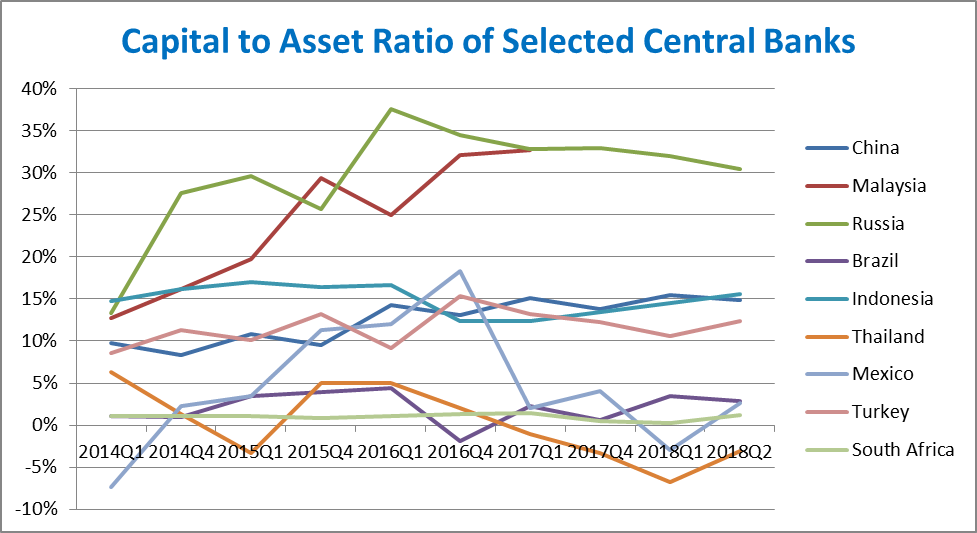

The following graph shows even for emerging countries, some central banks continued to function even after registering negative capital for extended periods.

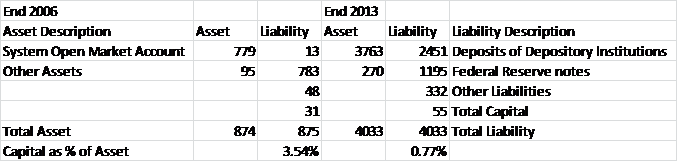

Even the Federal Reserve of USA registered a steep dip in its capital-to asset ratio – 0.77% at the end of 2013 from 3.54% at the end of 2006, the year preceding the onset of global financial crisis. It is nobody’s argument that the capital requirement of Fed can be a benchmark for any other central bank, as US dollar is the primary reserve currency of the world. However, the fact remains that even for Fed, resolution of a crisis is much more important than maintaining any debatable target capital adequacy ratio of a central bank.

Since the main component of RBI’s capital is its reserve, search for an optimal capital adequacy ratio for RBI would boil down to a search for adequacy of its reserve. To a large extent the asset counterpart of RBI’s reserve (on the liability side) is its Foreign Exchange Reserve. In my earlier blog post I have provided the relevant numbers for RBI (here) . In this post I want to dwell on the IMF framework for assessment of FOREX reserve of a central bank.

While building the framework, IMF’s main emphasis has been on the “key distinguishing characteristic of reserves- their availability and liquidity for potential balance of payment needs” (emphasis original). The global financial crisis has woken up all central banks, including those of advanced countries, to the critical role that availability of reserve plays in maintaining financial stability of a country. The IMF study has noted that most emerging market countries have “ accumulated more reserves in recent years than suggested by standard rules of thumb, with the median coverage ratio among EMs being around six months of imports, 200 percent of short-term debt, and 30 percent of broad money in 2009”. Analyzing the costs and benefits of reserves under macro-economic scenarios, IMF has worked out a new metric to assess adequacy of reserve. The metric for emerging market economies comprises four components- export income, broad money, short-term debt and other liabilities. Computed reserve adequacy, based on this metric, for selected countries including India shows that India is not an outlier in terms of forex reserve it is currently holding.

Finally, we hope that search for an optimal capital adequacy framework for a RBI would not turn out to be an exercise in futility. Let it not be : tale / Told by an idiot, full of sound and fury, /Signifying nothing.

Table: Actual Forex Reserve maintained as percentage of required

| Year | RUSSIA | BRAZIL | INDIA | INDONESIA | KOREA | CHINA |

| 2010 | 179% | 129% | 175% | 94% | 118% | 197% |

| 2011 | 174% | 156% | 159% | 144% | 117% | 175% |

| 2012 | 163% | 159% | 143% | 90% | 112% | 160% |

| 2013 | 151% | 159% | 144% | 123% | 114% | 155% |

| 2014 | 225% | 155% | 151% | 126% | 118% | 137% |

| 2015 | 264% | 192% | 156% | 122% | 124% | 120% |

| 2016 | 248% | 165% | 155% | 128% | 121% | 106% |

| 2017 | 265% | 162% | 159% | 128% | 106% | 97% |

Source: http://www.imf.org/external/datamapper/ARA/index.html

Table: Balance Sheet of Federal Reserve of USA

Source: Carpenter, Seth et. Al; The Federal Bank’s Balance Sheet and Earnings: A Primer and Projections, International Journal of Central Banking March 2015

IMF: Assessing Reserve Adequacy February 2011

Comments

5 responses to “Adequacy of Reserve and Economic Capital Framework for RBI”

Generally I don’t read article on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, quite nice post.

I like the reasoning in this article, but I would like to read more writing in this vein from you soon.

fftdkudjox,Hi there, just wanted to say, I liked this article. It was helpful. Keep on posting!

There are some fascinating cut-off dates in this article however I don’t know if I see all of them middle to heart. There’s some validity however I’ll take maintain opinion till I look into it further. Good article , thanks and we want more! Added to FeedBurner as well

asoczdj,Some really nice stuff on this website, I enjoy it.