One of the fundamental lessons of all financial scams is that there always exists enough number of gullible people to be conned by merchants of dream. For example, the people of 17th century Amsterdam started believing that prices of a bunch of tulip bulbs could rise to a level higher than the value of a furnished luxury house. It also happened during the dotcom bubble of late 1990s. Presently such a bubble is unfolding before our own eyes and the sad part of it is that some financial sector regulators are actively encouraging formation of this bubble in the name of financial innovation. It would be apposite here to recall the scathing criticism that the Financial Crisis Inquiry Commission of US Congress made of the regulatory failure leading to the sub-prime financial crisis: We conclude widespread failures in financial regulation and supervision proved devastating to the stability of the nation’s financial markets.

U.S. financial firms CME Group and CBOE are going to launch Bitcoin futures on December 18, followed by launch of binary options on Bitcoin by Cantor Fitzgerald. The US regulator for futures market, Commodity Futures Trading Commission (CFTC), has allowed introduction of these new products by these exchange platforms on the basis of self-certification submitted by them. The Commodity Exchange Act of USA allows such exchanges called Designated Contract Markets (DCM) to introduce new contracts by submitting a written self-certification to the CFTC that the contract complies with the Commodity Exchange Act (CEA) and CFTC regulations. It is the responsibility of DCMs to determine that the offering complies with the CEA and Commission regulations.

The CFTC in its press release of 1st December has referred to the IRS characterization of Bitcoin as a virtual “currency”. More than that, IRS has referred it as “convertible virtual currency”. I have already explained in my earlier blog why Bitcoin cannot be called a currency. In 2015, CFTC declared Bitcoin as a “commodity” by referring to the CEA act that includes “all services, rights, and interests in which contracts for future delivery are presently or in the future dealt in.” in the definitional boundary of commodity. The press release clarifies that “Bitcoin and other virtual currencies are encompassed in the definition and properly defined as commodities”. Under CEA commodities are classified into three categories-

(1) Agricultural commodities

(2) Excluded commodities which include, inter alia, an interest rate, exchange rate, currency, security, security index, credit risk or measure, debt or equity instrument, index or measure of inflation, or other macroeconomic index or measures

(3) Exempt Commodity which means a commodity that is not an excluded commodity or an agricultural commodity.

Prof. Shadab of New York Law School has argued in his written statement submitted to the CFTC that Bitcoin should be classified as “exempt commodities and not as excluded (currency) commodities “.

Each Bitcoin future contract on CME would be composed of 5 Bitcoins. The tick size (the minimum fluctuation) has been fixed at $5 per bitcoin, amounting to $25 per contract. Per person open position limit has been set at 1000 contracts. The daily price fluctuation of a Bitcoin future is limited to a 20% band above or below the prior settlement price. The settlement price will be Bitcoin Reference Rate (BRR). BRR is calculated by UK based crypto currency trading platform -Crypto Facilities Ltd, in partnership with CME. BRR is calculated by taking traded price and volume data from a few selected exchanges involved in spot Bitcoin trading. Price and volume data are obtained for 12 periods of 5 minutes each in the last hour of trading. For each time interval, a volume weighted median price is calculated. The overall price is average of these 12 prices.

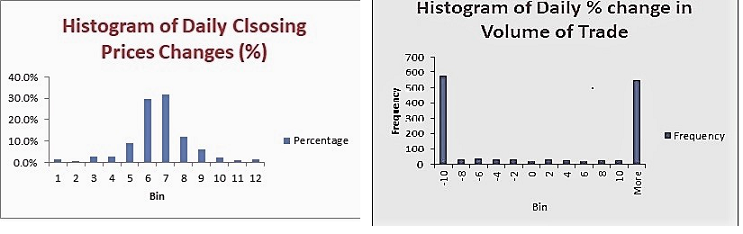

So, purely from methodological perspective, construction of reference price cannot be faulted. Since BRR is based on observed prices of Bitcoins traded on mostly unregulated exchanges, these prices are always subject to manipulation. The extent of volatility that can happen on these exchanges can be understood from the movement of bitcoin price on December 7. On this day, the price of 1 Bitcoin fluctuated from a high of USD 19,000 to a low of USD 4,000. If the price volatility is considered in conjunction with volume volatility (see the graphs below), Bitcoin may turn out to be Twenty First century’s first virtual Tulip.

Data source- here

Given this “insane volatility” ( as described by the chairman of BBCBS committee) of spot prices of a traded asset, the CFTC’s move in allowing derivative products on such an asset can be highly counterproductive. Apparently the CFTC believes that by bringing Bitcoin on a regulated platform it would be able to contain the speculative excess. The high margin requirement is expected to dissuade small investors to take positions in the Futures market, leaving the field open for play by institutional investors. More than 100 hedge funds have been created in the last one year to trade in digital currency only. It is reported that there is $10B of institutional money waiting on the sidelines to invest in digital currency today. To meet the requirements of these institutional investors, Coinbase, the US based Bitcoin exchange, has launched a new company to store securely their digital assets (see here). The company has claimed that it is already holding $9 billion of digital currency on behalf of its customers.

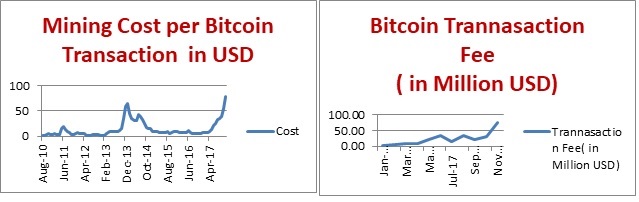

It should be a matter of regulatory concern about the source of Bitcoin’s price volatility. Apart from alleged price manipulation the most plausible explanation would be the intrinsic unbridgeable gap between demand and supply of Bitcoin. New supply of Bitcoin is largely a result of mining activities and the maximum supply of Bitcoin is a known figure. Against the back drop of a largely inelastic supply curve, the demand curve is driven by enthusiasts of cryptocurrency- a fast growing tribe. The fundamental inelasticity of the supply curve is getting reflected in higher and higher cost of Bitcoin based transactions. The following two graphs show how running Bitcoin network becoming costlier and costlier.

Given its inherent supply constraint, there is no possibility of Bitcoin becoming a global currency in its current form. Since Bitcoin is a highly sophisticated technological product, it attraction to young people is immense, like marijuana once was. But it should be the job of central banks to proclaim from the rooftop with as much force as it can command that: Trading and or Investing in Bitcoin is injurious to your financial health.